In this post, we will explain what tax-managed separately managed accounts (SMAs) are, clarify terms relative to performance measurement for tax-managed SMAs, and the challenges faced by performance professionals in measuring and attributing performance. After-Tax Returns Investors who care about maximizing after-tax returns may sometimes consider using tax-managed SMAs as part of their portfolio strategy.

KYC

Some Pointers On Picking New IT Providers

As financial services firms work to create efficiencies in the performance measurement and client reporting teams, there are some fundamental questions that need to be addressed from an information technology (IT) management perspective. These questions also apply to all IT systems that support other facets of securities operations. Firms need to be sure to include

Regulation

Future Boys, Future Girls & Fortune Tellers

The future is now. Or, at least for those willing to join me to get a great glimpse of the future of finance and more, we are going there on a fantastic financial voyage. “Future Boys, Future Girls & Fortune Tellers” is where we start, but looking at the lessons of the past will guide us to

Wall Street

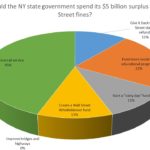

How Should the NY State Government Spend its $5 Billion Surplus from Wall Street Fines?

We have the results to our most recent Finger on the Pulse poll. Our FTF News editor, Eugene Grygo, recently posted a Minding the Gap column Can Good Come from the Sins of Wall Street?, where he discussed the fines imposed upon Wall Street and insurance firms for their sins during the Great Recession. Due to these

Compliance

Back to Business with CLO 2.0

Guest Contributor: Mike Molaro, Managing Partner, NorthPoint Financial Some of what were perceived to be the riskiest securities of the pre-financial crisis are back. The Collateralized Loan Obligation (CLO) market indicators are pointing to a profitable resurgence and growing inventory for these instruments. CLOs are special purpose vehicles (SPVs) with securitization payments in the form of

Wall Street

“What Is” Hedge Fund Administration?

Hedge fund administration involves the accounting, consulting and management of an investment firm’s key funds. A third-party, hedge fund administrator’s primary duties are to protect investors’ interests and to ensure that a firm’s funds are operating efficiently. More specifically, a hedge fund administrator’s responsibilities may include, but are not limited to: Calculating the Net Asset

Financial Technologies Forum (FTF)

Top 10 Wall Street Halloween Costumes for 2012

If you are struggling for a Halloween costume this year, hopefully one of our Wall Street themed ideas will inspire you: The 1 % – Wear a suit, attach some fake $100 bills and add lots of bling, buy a Lexus and laugh at middle-class people. The 47%—Paper your body with Medicare bills, Welfare cheese

Financial Technology

Onshore Outsourcing

Guest Contributor: Anil Budha, Managing Principal, GBP Financial Solutions A growing number of U.S. companies are saying goodbye to Bangalore, India and hello to America’s boondocks. Some IT organizations solicit domestic partners to supplement their offshore outsourcing projects, while others look to domestic providers to clean up messes created by offshore vendors or to avoid

Financial Technologies Forum (FTF)

The Magic List

“The Holy Grail” is what some people feel they have found when they land a spot in a brokerage company’s mutual fund advisory program, according to the Wall Street Journal. Achieving a spot on such a list for a new or small mutual fund is not an easy task. But, if they can accomplish it,

Fun Friday

FTF Food Review – Haru Sushi

When you work in New York’s Financial District, like we do, you understand that there are limited options for good lunch spots. While FTF can easily locate a food truck, we find it harder to find a quality restaurant for a client meeting. However, last week that changed when we decided to have a client