What is client reporting?

Susan Agbenoto, Director Investment Performance, Opus Investment Management

Client reporting coupled with face-to-face client meetings have been the signature of successful client-manager relationships.

With face-to-face meetings, figures can be articulated with sufficient context to bring understanding; shifting objectives can be more clearly explained, and the partnership is strengthened on both a social and professional front. These dialogues are key.

Backing these meetings, or in absentia of these meetings, are concise and informative client reports.

Here the manager’s progress is documented through relevant economic and market summaries that serve as the backdrop of the account’s performance, a review of the account’s good compliance standing, a snapshot of holdings, an excerpt of the account’s periodic performance versus a benchmark if applicable, and the characteristics of the portfolio among many other metrics. This is the heartbeat of client reporting. It behooves a successful firm to master this report whether it is done in-house or outsourced.

What are the options for outsourcing client reporting?

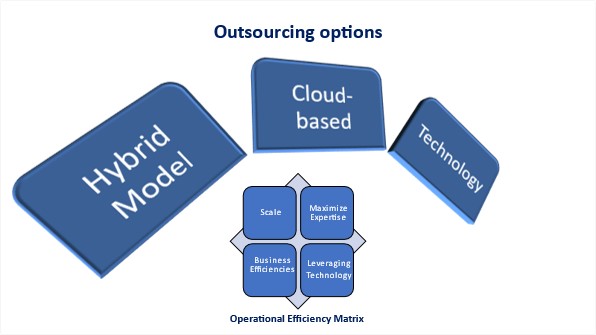

Outsourcing becomes a consideration depending on what I call the firm’s operational efficiency matrix as seen below. This consists of factors such as scale, expertise, business efficiencies and technology.

When a firm reaches a point where scale is an operational efficiency factor, for instance, an increase in volume with an accompanying increase in customization of reports but no parallel increase in talent, outsourcing becomes a consideration. A customized hybrid outsourcing model could be used where all the standardized reporting is done in-house, and the larger volume of customizations or special reports are outsourced, or vice-versa. This outsourcing can be cloud-based, where all of the data is housed in the cloud, or the data can be completely housed by the outsourcing provider.

Business efficiencies also come into play when there is a shift in resources from a budgetary versus a firm-focus perspective.

When the ratio of available talent of the firm to the deliverables is low enough to compromise quality, the efficiency of outsourcing could become a beneficial option.

The outsourcing company can take the production-related functions of client reporting, while the available talent is developed into more supervisory roles. The new roles could include quality assurance, niche skill-building, and other opportunities that could be refocused on producing quality client reports and creating an overall pleasant client experience.

In firms where there are long-standing personnel, there is a natural growth of skill, knowledge, and expertise from picking up functions, being a backup, and absorbing an added dimension of the current role.

Firms can fill senior roles with internal candidates as a result of this phenomenon. This natural progression of expertise makes room for client reporting to shift to an outsourced group while the expertise of the former client report owners is maximized to better serve the client and the overall firm.

Leveraging the Right Technology

Last, but not least is the leveraging of technology.

Within the last 15 years, client performance and reporting vendors have produced effective tools as they have learned from different types of firms with various asset classes, needs, unfulfilled vacuums, and even errors. Home-grown systems are becoming more challenging to maintain with coding programs changing, not being sustained, IT staff turnover, and the like.

To leverage the technology offerings, 100 percent of reporting can be outsourced, with the output received being well-designed reports, achieved scale efficiency, and most likely a dedicated team without the cost of buying and maintaining the technology needed to sustain this. This again can be either technology fully managed by the outsourcing firm, self-service technology, or a hybrid of the two.

With different client reporting trends, yet a growing demand for quality, a firm faced with these choices will need to examine both their operational efficiency factors and the impact on providing their clients with the best possible product.

(Susan Agbenoto is director, investment performance at Opus Investment Management, Inc. She has worked in investment performance for over 20 years, overseeing performance and attribution reporting, and the documentation of performance-related firm policies. She is also responsible for portfolio compliance and has her CIPM designation for the GIPS Standards. She oversees processes ensuring GIPS compliance within the firm and is skilled in the utilization of Microsoft Excel, Bloomberg, PowerBi, policy writing, presentation, and multitasking. She has been asked to participate in various performance industry-related conferences and will be a speaker at FTF’s Performance Measurement & Client Reporting event on Feb. 29, 2024 at Etc. Venues, 601 Lexington Ave. in New York City.)

Need a Reprint?