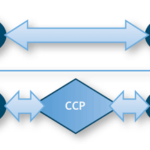

A central counterparty (CCP), also known as a central counterparty clearing house, aids the process of financial transactions by acting as an intermediary during a trade. Already fixtures in Europe, CCPs have become more prevalent in the US as they will be the buffer between over-the-counter (OTC) derivatives counterparties protecting them from default in the

Guest Blog

Consumers Are Ready for Omnichannel Banking—What About Banks?

Guest Blogger: Philip Farah, Cisco Internet Business Solutions Group (IBSG) Have you walked into a retail store lately and seen someone use his or her phone to “scan” a product’s bar code to get immediate access to reviews from consumers who have bought the product? This customer might also (to the chagrin of retail store

Back-Office

Industry Survey: Bridging the Transparency Gap

Industry Survey: End user firms want more transparency from their pricing and reference data vendors DOWNLOAD SURVEY RESULTS NOW Pricing vendors need to consider a more pro-active dynamic with their customers to provide more transparency into the due diligence process The pressure is on now more than ever to provide more transparency into the due

What is series

“What Is” Collateral Management?

In finance, collateral management is known as the process that yields a collateral agreement. Collateral is used as a pledge given to a lender to secure borrowing, generally in the form of an asset or an object of value agreed upon before a contract is signed. Some examples of collateral include: stocks, bonds, real estate,

Uncategorized

Finger on the Pulse

FTF News recently polled our readers and asked them how they think JPMorgan’s credit derivative losses will impact the industry Here’s what our readers said: Spur support for the Volcker Rule– 58.33% Give greater credence to the LEI push – 11.11% Cause the break-up of the big banks – 2.78% All of the above– 13.89%

Conference and Event Planning

The People Have Spoken

FTF News subscribers have spoken and selected the winners of the FTF News Technology Innovation Awards of 2012. Winning an award is a great honor; not that my shelves are piled high with trophies, but I do know that with an award there comes a party!!! Last Monday, we took a step back in time

Compliance

Featured Speaker from FINRA Enforcement

We are pleased to have Sarah Green, Senior Director in the Enforcement Division at FINRA sitting on a panel at our upcoming 2nd Annual Financial Crime & AML Compliance breakfast briefing on July 18th. Sarah specializes in anti-money laundering (AML) and other Bank Secrecy Act issues and has responsibility for consulting with both examination and

What is series

“What Is” the FIX Protocol?

The Financial Information Exchange (FIX) protocol is an electronic system of communication used to aid the processing of financial transactions and trading-relation communication such as Indications of Interest (IOIs). It is most commonly used for equities trading but has been gaining acceptance for many other types of securities. The FIX message reads as a series of

Guest Blog

Your Monte-Carlo Simulations Are Making Me Sweat

Guest Blogger: Steph Johnson, Head of North America – Aspectus PR What better timing than the first 90 degree day of summer to discuss the latest round of heat-related data center drama? As new prop shops with exabyte data crunching requirements spring forth in response to upcoming Volcker Rule legislation and financial firms continue to

Conference and Event Planning

Pass on Sitting

We’re always warned on long flights to stand up and stretch our legs but no one ever thinks about sitting at work or in a conference all day in the same frame. As a woman of the 21st century, I’ve been warned of the “Secretary’s Rear” of the 60s. In the words of Michelle Obama,