Keith Evans

Canada and the U.S. have shared a common standard securities settlement cycle for longer than most in the industry today can remember.

Industry participants in both countries successfully moved from a standard cycle of five to three business days after trade date (from T+5 to T+3) in 1995 and from T+3 to T+2 in 2017.

Today, Canadian, Mexican, and U.S. markets are preparing to move to a shorter cycle still — next-day settlement or T+1 — on May 27, 2024, in Canada and Mexico. Due to the Memorial Day holiday, the U.S. will follow a day later on May 28.

In Canada, about 25 percent of trades and 40 percent of the value cleared through CDS Clearing and Depository Services Inc. are in interlisted securities, meaning securities listed on both Canadian and U.S. exchanges.

These include major Canadian resource companies and six of the world’s top 100 banks. With U.S. capital markets being the largest in the world, and the Securities and Exchange Commission (SEC) having set the U.S. T+1 transition date in stone, Canadian and Mexican industry participants must change systems and processes to either match the shorter U.S. T+1 settlement or accommodate being on a mismatched cycle.

Clearly, staying on the same cycle makes sense for industry participants and investors. It wouldn’t make sense for Canada to get ahead of the U.S., which might later declare further requirements demanding backing changes out, redoing, retesting, and re-implementing in Canada.

For those scratching their heads as to why the Canadian testing schedule starts later and has a shorter duration than the American one, I’ll use a football analogy: we’ve got a common objective (T+1) and goalposts (May 27/28, 2024), but different ways of crossing the goal line.

For the uninitiated, there’s football (soccer), American football, and Canadian football (with Canada being the link between the old and new world).

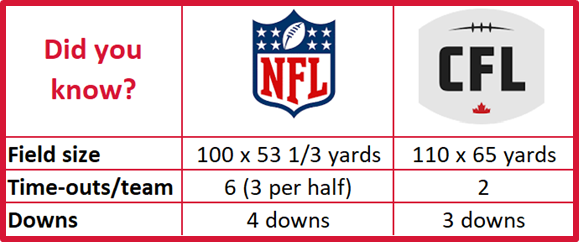

The differences between Canadian and American football — field size and rules among others (see table) — mean Canadian players have farther to run and less time to rest, so it’s not surprising that the playbooks of the two countries differ.

When it comes to T+1, Canada’s transition plan is necessarily back-end-loaded as the U.S. has a bit of a home advantage — a head-start on system changes and the SEC sets the rules. However, Canadian participants are fast followers and have the benefits of a simpler and more concentrated market.

The most important T+1 difference between Canada and the U.S. is that Canadian securities regulators have set a different matching time that we believe works best for investors (including those from overseas) in Canadian markets.

Rather than the SEC’s confirmation by midnight ET on T (9 p.m. cutoff at DTCC), Canadian regulatory staff are recommending a matching threshold of 3:59 a.m. ET on T+1.

This provides investors and industry stakeholders with — we think — the best of both worlds:

- Participants in different time zones Canada-wide, while adopting DTCC’s 9 p.m. ET on T for matching U.S.-settling securities, will have more flexibility in Canada:

- Custodians and buy-side firms will have more time to confirm trades;

- Sell-side firms will be better able to manage collateral and settlement;

- Equally important, counterparties operating in non-Canadian time zones — Asian, European, and U.K. — will have a bigger window to fix breaks. They will arrive at and get to work on T+1, hours before business starts in North America.

Compared to the two-year T+2 implementation, Canada began work on T+1 three years before the transition.

In the first year, the T+1 start-up was faster as there was a defined committee structure with many members who had worked on the T+2 project; a T+2 post-mortem report that had been completed with lessons learned; early agreement on CDS Scheduler changes and a list of assets moving to T+1; and logs of priority issues that continue to close steadily (see the CCMA’s website and newsletters).

National organizations representing investment industry participants everywhere had argued strongly for a Labor Day 2024 T+1 transition, as it would have afforded all North American participants a three-day implementation weekend before a move to T+1 on the same day.

We do not foresee issues arising from the one-day difference between Canadian and American implementation dates. Holiday processing is well understood on both sides of the border..

If anything, we see moving to T+1 a day earlier in Canada than south of the border as a positive. A “slightly smaller” Canadian bang on May 27, when markets are quiet due to American and U.K. markets being closed for holidays, is good preparation and may provide insights for the big bang the next day, when U.S. markets adopt T+1.

(Author Keith Evans is the executive director of the Canadian Capital Markets Association (CCMA). After working for more than 36 years at Canada’s national depository and clearing corporation, including 10+ years as executive director, operations responsible for all day-to-day operational delivery and strategy of the Canadian Depository for Securities (CDS), Evans was tapped to lead the Canadian industry’s transition from T+3 to T+2, successfully implemented in the fall of 2017. A sucker for punishment, Keith now heads the cross-industry and cross-border coordination of Canada’s T+1 efforts.)

Need a Reprint?

Leave a Reply