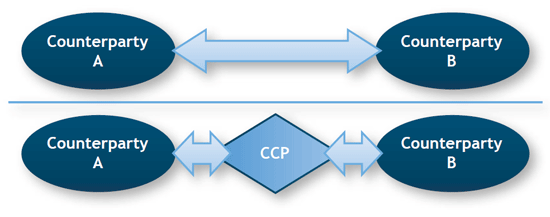

A central counterparty (CCP), also known as a central counterparty clearing house, aids the process of financial transactions by acting as an intermediary during a trade. Already fixtures in Europe, CCPs have become more prevalent in the US as they will be the buffer between over-the-counter (OTC) derivatives counterparties protecting them from default in the clearing of formerly bilateral OTC transactions.

A central counterparty (CCP), also known as a central counterparty clearing house, aids the process of financial transactions by acting as an intermediary during a trade. Already fixtures in Europe, CCPs have become more prevalent in the US as they will be the buffer between over-the-counter (OTC) derivatives counterparties protecting them from default in the clearing of formerly bilateral OTC transactions.

CCPs were created to increase efficiency and transparency in the financial markets by mitigating risk in unregulated trades. Although CCPs initially functioned as a tool to reduce trading costs and to settle contracts, the role of CCPs has expanded to include both the processing and management of the contract and trade.

The parties involved in the trade use a process called “novation” which is when they hand over their rights to the central counterparty. The CCP then creates a contract with the buyer as well as a separate contract with the seller.

In a typical trade involving a central counterparty, the seller of the financial instrument gives the instrument to the CCP, which is then responsible for managing the transaction, as well regulating and selling the product to the buyer.

In the case that the buyer defaults, the CCP is in charge of settling the trade. In this sense, the CCP then becomes responsible for managing risk.

The CCP has three primary functions:

- Clearing, involves the negotiation of the transaction;

- Settlement, which is the date when the trade is completed;

- And, Custody, which involves the central security depositions (CSDs) that hold onto the securities at the heart of the transaction.

Some of the industry’s major CCP providers include: the CME Group, Eurex and EuroCCP.

Need a Reprint?

Leave a Reply