To cope with the pandemic's challenges, securities operations departments have digitized processes and begun to plan larger digital strategies.

Dominic Crowe

For securities operations at financial services firms, the COVID-19 pandemic has created a perfect storm for digital transformation.

A year since the COVID-19 pandemic began to put a strain on middle and back-office operations, some financial services firms have not only made short-term changes to their securities operations protocols but have begun to plan more lasting digital transformation strategies, industry executives say.

“We are seeing more in the way of RFPs with regards to outsourcing the middle and back-office services that asset managers have today,” says Dominic Crowe, the North American head of custody and fund services at Citi.

Much of the strain came via the pandemic-induced global market volatility.

“The volatility happened when everyone was moving to working from home,” recalls Virginie O’Shea, founder of Firebrand Research.

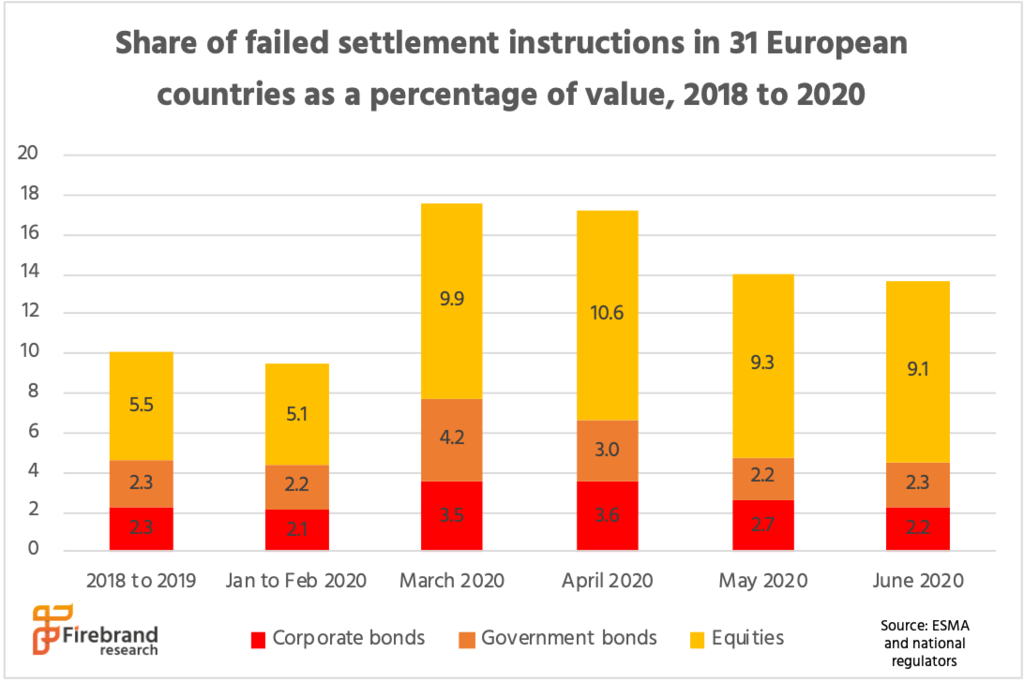

In the short term, the crisis delayed regulatory filings, affected corporate actions, and altered communication protocols. Data from the European Securities and Markets Authority showed a steep rise in settlement failures across both debt and equity in March 2020 when volatility peaked and the lockdown began, O’Shea says (See chart below).

In corporate actions, for example, the markets were in the middle of a corporate actions “season” when the crisis hit, Citi’s Crowe says, and some companies that had previously announced planned dividends ended up retracting them on short notice.

“We saw a lot of undoing, rather than doing, and that was also a lot of work to make sure that the feeds that we are getting from the industry were reconciled,” Crowe says.

Bruno Campenon

For some firms, the pandemic crisis put strains on inefficient communications processes with agents and counterparties, according to Bruno Campenon, head of financial intermediaries and corporates, at BNP Paribas Securities Services. Often, procedures for managing back-office operations are very point-to-point, and as employees were dispersed remotely, these informal structures became even more difficult to manage.

“The problem that you have is that is it all very bespoke. … There is no particular automated workflow around it,” Campenon says.

To address these issues, some BNP Paribas Securities Services clients have increasingly expressed interest in communication infrastructure platforms such as Kingfield and AccessFintech, which have built-in intelligence designed to standardize securities operations, Campenon says. Other firms are extending the front-office Symphony collaboration platform to their back-office teams, he adds.

Clients are also pushing for increased dematerialization, Campenon says, noting that some securities still have paper certificates, and those paper-based processes are the most difficult to manage in crisis situations.

To speed the move toward digital processes, firms are increasing the adoption of electronic signatures and similar tools that can replace can paper processes with digital ones. In some jurisdictions, for example, the tax reclaim process remains very paper-intensive, but in jurisdictions where processes are becoming automated, clients are seeing significant efficiency improvements. Campenon expects the turbulence experienced this year to prompt increasing industry pressure for digitization of remaining paper-based processes.

“It starts from the clients trying to push for it, then the agent pushing for it, and ultimately the tax authority to progressively adapt to this,” Campenon says.

The pandemic caused some processes to become digitized immediately, Crowe says. For example, while Citi has long offered clients digitized board administration packages for fund boards, including digital board books and other materials, some clients have continued to prefer paper copies. During the pandemic, that changed quickly.

Similarly, at Citi, some firms suddenly began using Apple iPhones and iPads to check trade statuses using data oversight tools that they had never accessed before, Crowe says. This includes receiving automated push alerts for potential trade fails.

Custodians say that crises such as the COVID-19 pandemic often push clients to consider outsourcing more of the technology-intensive operations.

Brenda Lyons

“Custody, fund reporting, and administration activity have become much more accepted as outsourced services and we are seeing that trend continue into the middle and front office,” says Brenda Lyons, head of product for State Street’s Institutional Services Group.

For example, custodians have long managed back-office accounting functions and have the extensive infrastructure required to perform and disseminate net asset value calculations daily. This same expertise is increasingly being used to support the Investment Book of Record (IBOR) that clients rely on to make daily investment decisions, and performance and risk calculations, Lyons says.

At Citi, the ways in which clients are looking to accelerate their digital transformations vary significantly, according to Crowe. For clients that have already invested in large order management systems, such as Aladdin from BlackRock Solutions, Citi team members often log into the client’s version of the OMS to reconcile data for the front, middle and back offices.

For smaller clients who may still be using legacy databases to manage processes, more heavy lifting may be involved to streamline operations. Still other clients may only choose to outsource parts of their business, such as in derivatives, where they are having the most problems with their data, Crowe says.

Firms are wise to move quickly to correct operational weaknesses that the pandemic crisis may have uncovered, O’Shea says, because challenges faced during the pandemic have caught the attention of regulators.

“I think regulators were quite lenient in terms of understanding that the industry was struggling, so they gave them some leeway for a while,” she says. “I don’t think there are going to be endless runways for them to have leeway here.”

(Editor’s Note: This story originally ran on February 2, 2021, as a feature story on FTF’s SecOps Online pages.)

Need a Reprint?