Grygo is the chief content officer for FTF & FTF News.

As the winter of our discontent with cryptocurrencies continues, it’s clear that changes have to be made and that the next crypto spring will either not happen at all or it will be a radical rejection of the Wild West status quo.

One path is an outright ban. Some like Charlie Munger, the vice chairman of Berkshire Hathaway, are calling for a ban of cryptocurrencies like the one underway in the Peoples’s Republic of China.

“Such wretched excess has gone on because there is a gap in regulation. A cryptocurrency is not a currency, not a commodity, and not a security,” Munger says in an opinion piece for The Wall Street Journal. “Instead, it’s a gambling contract with a nearly 100 percent edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity. Obviously, the U.S. should now enact a new federal law that prevents this from happening.” (The piece can be found here: https://on.wsj.com/3linsvP).

Other voices are emerging and are pushing for clarity on what cryptocurrencies are and thus how to control them.

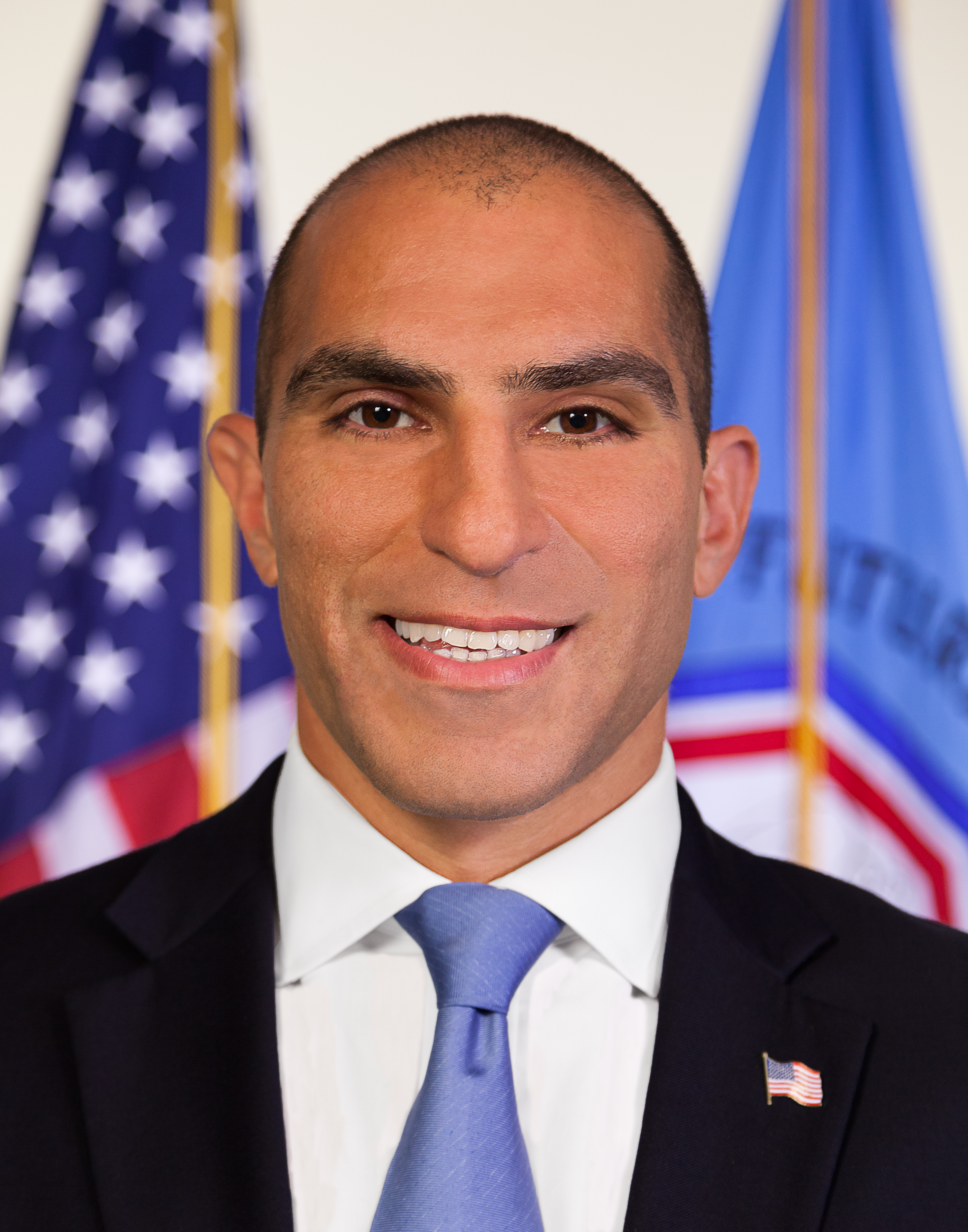

A leading voice for clarity and regulation is Rostin Behnam, chairman of the CFTC, who asserted again the new role the regulator could play in the crypto game when he gave the keynote address at the winter meeting of the ABA Business Law Section Derivatives & Futures Law Committee on Feb. 3.

The chairman reminded the audience that crypto-based efforts are on the CFTC’s radar.

“Now, as this audience may know, there are several digital platforms under CFTC oversight that offer digital asset derivatives. … Regarding new products, in 2018, DMO [Division of Market Oversight] and DCR [Division of Clearing and Risk] issued a joint advisory addressing virtual currency derivatives product listings. Though not a compliance check-list, the advisory reminds exchanges and clearinghouses of their self-regulatory obligations for the markets they operate and clarifies the commission staff’s priorities and expectations in its review of new virtual currency derivatives to be listed or to be cleared, regardless of the process chosen for doing so,” Behnam says. (Winter photo by Tim Gouw on Unsplash)

“Now, as this audience may know, there are several digital platforms under CFTC oversight that offer digital asset derivatives. … Regarding new products, in 2018, DMO [Division of Market Oversight] and DCR [Division of Clearing and Risk] issued a joint advisory addressing virtual currency derivatives product listings. Though not a compliance check-list, the advisory reminds exchanges and clearinghouses of their self-regulatory obligations for the markets they operate and clarifies the commission staff’s priorities and expectations in its review of new virtual currency derivatives to be listed or to be cleared, regardless of the process chosen for doing so,” Behnam says. (Winter photo by Tim Gouw on Unsplash)

“Additionally, although not required for self-certified products, platforms have continued to reach out to DMO’s product review staff prior to listing new digital asset products,” Behnam says. “Staff’s review of those products primarily focuses on Core Principle 3 compliance which addresses susceptibility to manipulation. The platforms also share draft information sharing agreements with staff.”

“Relatedly, DMO is currently considering whether DCMs [designated contract markets] that list cryptocurrency-based derivatives contracts, and/or are affiliated with cryptocurrency spot markets, should adopt policies and procedures to restrict the trading by: (1) DCM employees in affiliated cryptocurrency spot markets; and (2) cryptocurrency spot market employees on affiliated DCMs,” according to the chairman’s speech.

“DMO compliance and its chief counsel branch staff recently held meetings with several DCMs that either list, or plan to list, cryptocurrency-based futures contracts, and/or are affiliated with cryptocurrency spot markets, to obtain information relating to their employee trading restrictions,” the chairman says.

So, the CFTC has not stopped mulling new regulations and Behnam wants Congress to act on crypto regulations. But getting Congress to focus on this issue will be a challenge even as the crypto winter drags on and the FTX trials get underway.

Rostin Behnam

Ultimately, though, Behnam does not appear to be in the crypto-banning camp.

“The crypto market was shaken to its core last year, on several different fronts. In my view, the bankruptcies, failures, and runs only validate that action is needed. The ecosystem is vast, will not vanish, and needs comprehensive legislation. The cryptoverse is not a closed system,” Behnam says.

“Regulation is necessary to protect customers and to prevent failures which cannot predictably be contained within any boundaries across the domestic and global financial markets. Regardless of whether one or many occur in 2023 or 2033, we must act. There is a new Congress, and I will continue to engage and provide technical assistance to draft legislation, as requested,” Behnam says.

Need a Reprint?