An FTC ban on noncompete clauses and contracts may impact many firms great and small.

Grygo is the chief content officer for FTF & FTF News.

A decision by the Federal Trade Commission (FTC) rarely has multiple impacts on Wall Street securities trading institutions but a nationwide FTC ban on noncompete clauses and contracts is forcing the issue at many firms great and small.

Noncompetes have become an essential aspect of Wall Street’s hiring and firing of executives, managers, and all others who work for firms engaged in securities trading and other related financial services. It’s an industry that values secrets, proprietary information, customized IT infrastructures, and cutting-edge research and development.

Wall Street is not into sharing. Wall Street firms and others across the globe rely on secrets and will protect them as viciously as a lioness guards her cubs.

So, the nearly final FTC rule, slated to take effect in 120 days, will ban contracts that prevent former employees from sharing trade secrets and more with new employers. It is intended to promote competition by “protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.”

There are a few caveats

“Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions,” according to the FTC.

“Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance,” according to the FTC. “Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.”

The ban is broad and while the FTC does not regulate the financial services industry in the same way that the SEC and CFTC do, Wall Street firms have been paying attention. They have been mostly focused on how to craft future noncompete agreements.

“Generally, the rule will impact all employers other than certain banks, savings, and loan companies, non-profits, and common carriers, which are not subject to the FTC’s authority by law,” according to an alert sent out by law firm Polsinelli, based in Kansas City, Mo. “The rule applies to paid and unpaid workers, including employees, independent contractors, externs, interns, volunteers, apprentices, and sole proprietors. The rule does not apply to the franchisee in a franchisor relationship.”

“Look, I think this …will be especially important to the financial services industry and to the private equity industry where they’re dealing with complicated business arrangements, highly paid executives who really have a lot of access to trade secrets and goodwill,” says Douglas Brayley, a Ropes & Gray partner, in a recent interview with Bloomberg that is available online: https://bit.ly/4bbHahg

Most observers note that rule has a broad sweep.

“Once (and if) it goes into effect, it will prohibit employers from imposing non-competes on workers … and the ban will extend to all contract provisions that create functional non-compete clauses; i.e., any other contractual clause that may have the ‘effect’ of prohibiting workers from seeking or accepting other employment,” according to an opinion piece published by the law firm White & Case: https://bit.ly/49SE0hz . “This means that an NDA [non-disclosure agreement] that has the ‘effect’ of limiting a worker’s mobility may also be banned.”

In addition, the rule “requires employers to give notice that existing non-competes are no longer enforceable. In addition to preventing employers from entering into new non-compete agreements as of the effective date, the rule would also require employers to notify their employees that covered existing non-competes are no longer enforceable,” according to White & Case.

Lina Khan

Yet, in a prepared statement, FTC Chair Lina M. Khan expressed confidence in the sweep of the rule.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” Khan says. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

In addition, the FTC is suggesting that companies use alternatives to noncompetes via trade secret laws and NDAs that “both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95 percent of workers with a noncompete already have an NDA,” according to the FTC.

“The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions,” FTC officials say.

Not so fast, says SIFMA.

In a statement released on April 23, Kenneth E. Bentsen, Jr., president and CEO of SIFMA, expressed concerns about the ban.

“We are carefully reviewing the final rule released today and appreciate that the FTC carved out the sale of businesses and the existing agreements for senior executives,” Bentsen says.

“We, however, remain concerned that the near-categorical prohibition on non-compete clauses would hurt competition and the economy by terminating long-established practices of using non-compete clauses to protect a business’s sensitive information. The proposal also greatly underestimated its compliance costs, while failing to establish a clear record on its benefits or necessity,” Bentsen says.

As SIFMA considers its next steps, the U.S. Chamber of Commerce and likely other business and trade associations will challenge the rule in court.

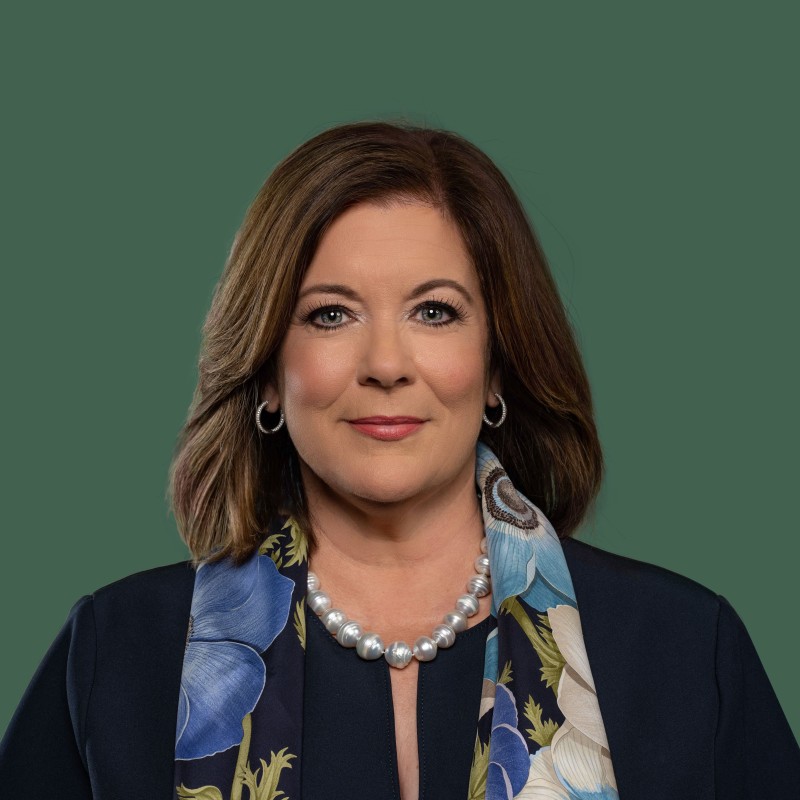

Suzanne P. Clark

“The Federal Trade Commission’s decision to ban employer noncompete agreements across the economy is not only unlawful but also a blatant power grab that will undermine American businesses’ ability to remain competitive,” says Suzanne P. Clark, president and CEO of the U.S. Chamber of Commerce. “The chamber will sue the FTC to block this unnecessary and unlawful rule and put other agencies on notice that such overreach will not go unchecked.”

“Since its inception over 100 years ago, the FTC has never been granted the constitutional and statutory authority to write its own competition rules. Noncompete agreements are either upheld or dismissed under well-established state laws governing their use,” Clark says.

Brayley and other lawyers are advising firms to compile and review their noncompete agreements and consider their next steps if the rule goes into effect despite the legal challenges.

Need a Reprint?