Maureen Lowe, Founder and President of FTF, discusses what the new, upcoming website means for our readers and clients. The new site is scheduled to go live Q3 ’15.

Wall Street

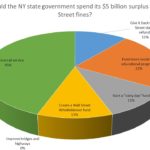

How Should the NY State Government Spend its $5 Billion Surplus from Wall Street Fines?

We have the results to our most recent Finger on the Pulse poll. Our FTF News editor, Eugene Grygo, recently posted a Minding the Gap column Can Good Come from the Sins of Wall Street?, where he discussed the fines imposed upon Wall Street and insurance firms for their sins during the Great Recession. Due to these

Uncategorized

FTF News Video: How to Build a Robust Op Risk System

CIT’s head of Op Risk discusses novel ways to improve surveillance and launch initiatives with FTF News editor, Eugene Grygo at the recent OpRisk New York 2014 conference in November. Prasad Kodali, head of operational risk at CIT, is leading a program to integrate the processing of operational loss data into his Op Risk program.

Uncategorized

Happy Holidays from FTF!

Uncategorized

FTF Rings Nasdaq Opening Bell

Financial Technologies Forum was honored to ring the Nasdaq Opening Bell on September 18, 2014, kicking off our annual FTF SMAC NY event focusing on social media and compliance in financial services. Experience the exciting moments with the FTF team as you view behind the scenes footage from the ceremony here: View the complete ceremony

Cloud

Financial Trading Infrastructure: The Era of Cloud 2.0

Guest Contributor: Jacob Loveless, CEO, Lucera Financial Infrastructures The freedom to try new things The equity downturn has fueled a trend in multi-asset trading that is prompting firms to test new strategies. They realize they can no longer merely trade or price a single asset class. To compete, they must have asset diversification and multi-asset

Uncategorized

Utilizing Big Data in the Financial Markets

Guest Contributor: Larissa J. Miller, Founder and Board Member of Stuart Investments The financial markets have always been blessed with big data. While other industries are catching up to the markets in terms of size, the financial markets have moved on to the incorporation of the data to existing models, learning models and strategic decision

Uncategorized

Preparing for a Regulatory Exam: Tips and Guidelines

Guest contributor: Jimmy Douglas, Director of Alliances and Industry Relations at Smarsh. For financial services firms, policies governing the use of electronic communications, the preservation and production of electronic communications records, and evidence of message supervision procedures are a big part of FINRA and SEC examinations. According to an annual analysis of FINRA disciplinary actions released

Uncategorized

How to Engage Millennials: Best Technology Practices for Financial Advisors

Guest Contributor: Cheryl Nash, President, Investment Services, Fiserv A recent multigenerational survey from TIAA-CREF reveals financial advice has the highest impact on Millennials, the 77 million young Americans who, according to Nielsen, represent 24 percent of the U.S. population. A somewhat surprising statistic when the profile of this demographic is “I’ve got it; I can

Uncategorized

MiFID II: It’s over to ESMA

Guest Contributor: Catherine Houston (Operational Processing and Repo specialist, Rule Financial) Having recently been voted through the European Parliament, the clock is now ticking on the next phase of the Markets in Financial Instrument Directive (MiFID) II implementation process. The onus is now on the European Securities and Markets Authority (ESMA) to take these principles