Basel III is a set of reform measures for the banking sector established by the Basel Committee on Banking Supervision (BCBS) in 2010 and 2011. The BCBS is a board of advisors organized by central bankers and is comprised of the Group of Ten countries. Basel III is the third installment of the Basel implementation

What is series

“What Is” a Swap Execution Facility (SEF)?

A swap execution facility, or SEF, is a regulated transaction platform created under the Dodd-Frank Wall Street Reform Act (title VII). Dodd-Frank requires non-bilateral swaps to be transacted through a formal platform or via a SEF, using a using a designated contract market (DCM). This new form of regulation amends what was previously known as

What is series

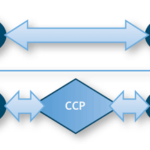

“What Is” A CCP?

A central counterparty (CCP), also known as a central counterparty clearing house, aids the process of financial transactions by acting as an intermediary during a trade. Already fixtures in Europe, CCPs have become more prevalent in the US as they will be the buffer between over-the-counter (OTC) derivatives counterparties protecting them from default in the

What is series

“What Is” Collateral Management?

In finance, collateral management is known as the process that yields a collateral agreement. Collateral is used as a pledge given to a lender to secure borrowing, generally in the form of an asset or an object of value agreed upon before a contract is signed. Some examples of collateral include: stocks, bonds, real estate,

What is series

“What Is” the FIX Protocol?

The Financial Information Exchange (FIX) protocol is an electronic system of communication used to aid the processing of financial transactions and trading-relation communication such as Indications of Interest (IOIs). It is most commonly used for equities trading but has been gaining acceptance for many other types of securities. The FIX message reads as a series of

Derivatives

“What is” A Derivative?

A derivative is a traded security in the form of a contract between two parties based on an underlying asset or multiple assets. These financial contracts are most commonly used to hedge financial risk. Derivatives can also be used for speculative purposes such as predicting the future value of an asset and potentially profiting or

Data Management

“What is” the LEI Initiative?

The Legal Entity Identifier (LEI) initiative is an effort to establish a global system that assigns reference numbers to uniquely identify entities involved in global securities trading markets. By using a global identification system, the industry can apply LEIs to mitigate financial risk, increase financial stability and provide new transparency into securities transactions. The system