Guest Contributor: Philip Sindel, President & CEO, Olmstead Associates, Inc.

Guest Contributor: Philip Sindel, President & CEO, Olmstead Associates, Inc.

If you have been keeping up with trends within securities industry operations and technology you have probably encountered the newest set of acronyms, all of which revolve around BOR or Book of Records. The most recent discussion has been whether ABOR (Accounting Book of Records) is deficient when it comes to the investment management process and needs to be supplemented by the creation of IBOR (Investment Book of Records). These BORing acronyms are just another way of trying to address a question that the industry has been grappling with for many years without success: Is the total position for each security known both across the firm and within each individual account that holds the security? In other words, do I have transparency to all positions and cash throughout the firm? The answer in many cases is a special project with the results being a custom Excel spreadsheet.

This is not just an academic exercise as accurate and timely positions and cash are integral to both the investment management process and to enterprise risk management and compliance. With market and regulatory changes, increased use of multi-asset strategies, OTC derivatives and other “alternative” investments, achieving accurate and timely information has become more difficult yet more important than ever.

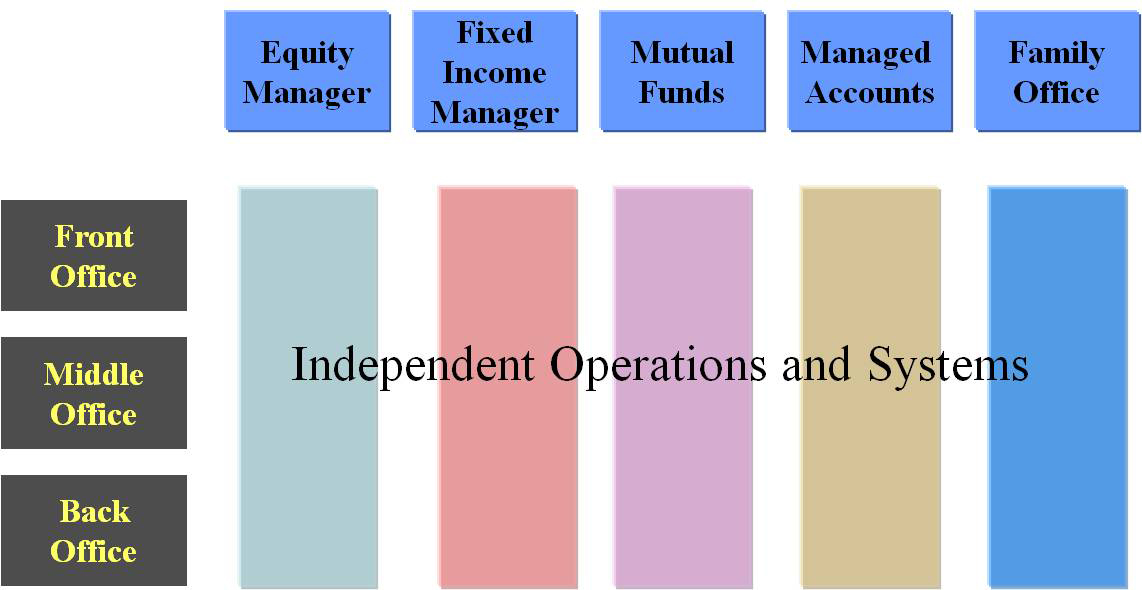

Staying hip and using the current proposed answer, IBOR, the question becomes what is its definition? Is IBOR a data management issue, is it a data aggregation issue, is it a technical architecture issue, is it a business process issue, is it an application solution issue? The answer is probably all of the above. As the sample graphic below depicts, firms within the securities industry still tend to have multiple functional and data silos based on combinations of products, subsidiaries, asset classes.

Therefore implementing an IBOR requires figuring out how to receive accurate and timely information from multiple internal and external platforms that will need to be updated in real time to reflect transactional activity during the day. Making a business case for this type of project is difficult because there is typically a high upfront cost coupled with a back end benefit that doesn’t lend itself to be easily quantified. Even though the consolidation of all investment assets should always be the eventual target, the path needs to be defined as value added steps where each step delivers a benefit that justifies the added cost. Organizations can consider options such as:

- Can I use something that is already in place?

- Can real-time become near real-time or scheduled intra-day updates and still provide value?

- Can I work with existing third party providers or vendors?

- Can I look at what will improve risk and compliance?

Where there is agreement is that what IBOR represents, a consolidation of all investment assets, is not going to resolve itself or disappear and will only increase in importance at all levels of a firm. Therefore putting off developing a game plan to implement the concept within your own firm because of the uncertainty of cost and benefit will only result in addressing it at a time that is simply too late.

Hear more from Phil Sindel and Olmstead Associates at FTF’s security industry training courses. Check out the available courses online! Courses focus on Derivatives & Other Complex Securities, Fixed Income Securities, Custody & Securities Operations, Portfolio Management & Trading and a Securities Industry Overview.

Need a Reprint?

Leave a Reply