Tracy Chou

Securities settlement fails are costing the industry billions in operational overheads and fees today. This is only intensifying under the Central Securities Depositories Regulation (CSDR) Settlement Discipline Regime in Europe and shortening settlement cycles.

With the deadline for T+1 settlement implementation coming up on May 28, 2024, in the U.S., solving post-trade frictions that get in the way of automation is now an urgent must. (Canada is moving to T+1 on May 27.)

One of the reasons why trades fail to settle on time is because of a lack of transparency into the post-trade lifecycle. In a world where we can track almost anything we order with just a click of a button, there’s no reason why we shouldn’t be able to track securities transactions from end to end as well.

This transparency is needed to ensure smooth deliveries and avoid surprises. It allows firms to be able to detect discrepancies and fix exceptions prior to the settlement date, reduces operational risks and costs, improves liquidity and capital management, and helps ensure regulatory compliance.

Sounds great, but how do we get there?

Luckily, a solution exists that doesn’t require you to reinvent the wheel.

It’s called the Unique Transaction Identifier and it’s key to unlocking the benefits of transparency in securities settlement transactions. What’s more, it’s an existing, industry-recognized standard – the ISO 23897:2020. And industry-wide adoption of it – which is currently gaining momentum – is set to help firms make many settlement fails a thing of the past.

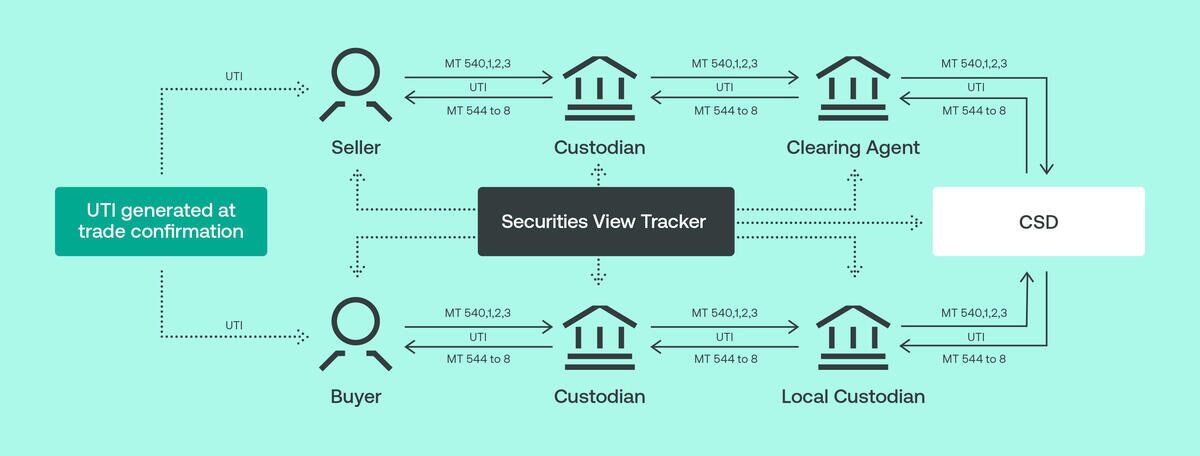

That’s because the UTI facilitates greater transparency, enabling market participants to track transactions at every step of the securities lifecycle in real time. Just like tracking a package in our everyday lives. This way, you can identify transactions at risk of failing and take corrective action ahead of the settlement date.

It’s that simple.

The UTI is a game-changer for securities markets.

As its name suggests, it’s a 52-character, globally unique alpha-numerical code that can be assigned to each financial transaction, such as securities trades, derivatives contracts, or securities financing transactions. This unique reference enables true end-to-end tracking, from execution to settlement, and across different parties and jurisdictions.

By leveraging the UTI, many technology platforms can string together the instructions and status between different counterparties on the transaction level. As a result, provide end-to-end trade status reporting, reconciliation of settlement instructions from across both legs of the settlement lifecycle, as well as early warnings on settlement exceptions. This reduces the possibility of instruction errors, mismatches, duplications, or counterparty missing information.

The UTI is already used in some regulatory regimes today for transaction reporting purposes, such as the Dodd-Frank Act in the US, the European Market Infrastructure Regulation (EMIR), and the Securities Financing Transactions Regulation (SFTR) in the EU. And the UTI can already be consumed under Swift’s category 5 messages.

The UTI brings a number of immediate benefits for post-trade because it can:

- Facilitate trade matching and confirmation by enabling you to compare and verify trade details between counterparties;

- Provide trade reconciliation by allowing trading counterparties to detect and resolve discrepancies or errors in trade data across different sources;

- Streamline trade reporting by enabling you to aggregate and submit transaction data to relevant authorities or repositories using a single identifier;

- Improve certainty in trade status tracking along the settlement chain; and

- Enhance trade monitoring by enabling end-users to analyze and oversee transaction activity, risk exposure, and performance across different markets and instruments.

Industry-wide UTI adoption is critical to unlock the full benefits.

The good news is that it’s gaining momentum. There are already 50-plus individual Business Identifier Codes (BICs) that are sending and receiving the UTI today.

The UTI standard is a valuable solution that can enhance post-trade efficiency by enabling you to identify and track transactions throughout their lifecycle. However, it requires industry collaboration to adopt and use it.

This is a major focus for us at Swift. Together with a working group of financial institutions and several industry associations, we’ve developed market guidelines to help firms implement the UTI in their systems and adopt it in their workflows.

How do you stop settlement fails? The answer is clear. To avoid them, it’s time to get a better view of securities transactions. And that means collaborating to create a more efficient, resilient, compliant, and competitive financial market. The UTI is essential in this. And it’s up to all of us to pass it on.

(The author of this blog posting Tracy Chou is a senior securities expert at Swift, overseeing the go-to-market effort in securities settlements, digital assets, and corporate actions covering North America and LATAM.)

Need a Reprint?

Leave a Reply