Guest Blog Contributors: Mary Harris (left), Business Manager TriResolve and Susan Hinko (right), Head of Industry Relations TriOptima

The new year brings with it an onslaught of requirements for managing OTC derivative portfolios, cleared and uncleared alike; and also presents new challenges with parallel tracks for processing and collateralizing the transactions. While standardized credit and interest rate swaps are going into clearing, things seem to be getting more complicated rather than simpler.

First, clearing does not eliminate the need for independent reconciliation and verification of transactions. Firms on the buy side intend to reconcile cleared trades with their dealer counterparties to maintain fiduciary oversight of the transactions. Uncleared trades, whether legacy or new, collateralized or uncollateralized, must be reconciled under both US and European regulations coming into effect in 2013. Valuation methods must be agreed between the counterparties along with the reconciliation parameters and procedures.

Even if regulations don’t directly affect a buy side firm, dealers are increasing their demands for regular reconciliations in order to meet new regulatory standards. And with dealers submitting trades to the swap data repositories for reporting purposes, buy side firms are eager to validate the information that has been sent to regulators on their behalf.

Where many buy side firms chose in the past to rely on their counterparties to reconcile their transactions and make the margin calls, the evolving complexity of the clearing and collateralization process has pushed firms to take greater operational responsibility for their own portfolios. And reconciliation is a first step in an increasingly complex margining process.

Margin Process Challenges

Pressure on capital allocation is growing as stricter collateralization policies are implemented for both bilateral and cleared relationships, amplified by Basel III requirements. This translates into a much more challenging margin process. Collateral desks will be managing more agreements and making more payments due to several factors:

- Normal bilateral portfolios will continue to be collateralized under CSA arrangements ;

- There is increased segregation of independent amounts/initial margin;

- Give-up/clearing agreements will be added for each FCM acting as an agent for a buy side firm;

- The benefits of netting are reduced with clearing silos by product type and even by geography; coupled with the additional independent amount/initial margin this will increase collateral demands;

- The collateral for margin call will need to be of higher quality;

- With the proliferation of margin demands, funding calculations will need to be completed earlier in the day.

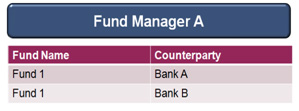

The chart below illustrates what relationships a fund manager would have had in the bilateral world before the new clearing and margin requirements were introduced. Each counterparty had a CSA agreement with a fund, and collateral would have been exchanged depending on the valuation of the entire portfolio. All transaction types were covered under the CSA and the collateral calculation was netted across the transaction types (interest rate, credit, equity, commodity swaps) so only one collateral amount was delivered. This was relatively simple and also optimized the use of collateral.

Pre-Clearing Collateral Relationships

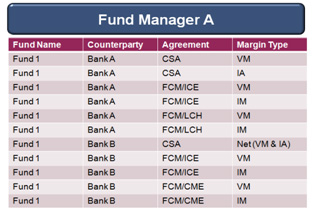

However, in the post-clearing world with new margin relationships and posting requirements, the process has gotten more complex with multiple types of credit support agreements in effect for each counterparty depending on the transaction type and the need for variation or initial margin postings. Collateral desks will be managing more agreements and making more payments as indicated in the chart below.

Post-Clearing Collateral Relationships

Optimizing the Margin Process

In order to meet the challenges of the new margining landscape, a firm can implement procedures to optimize its ability to identify collateral requirements, resolve disputes and move collateral efficiently. It is essential that the process be automated as much as possible. While many firms have been handling their margining process on spread sheets on an ad hoc basis, this is not a viable strategy for the new environment. Automation will enable a firm to move beyond the basics quickly and focus on exception processing. It will also provide maximum time to resolve potential disputes. Getting information as early in the day as possible will also allow for more time to resolve those disputes, finalize collateral calls, and enable accurate funding estimates to ensure collateral is delivered to the right place at the right time. Collateral management begins with a robust reconciliation process so it’s important to either build an internal system or look for service providers that offer strong solutions.

Need a Reprint?

Leave a Reply