(Editor’s note: As FTF News has reported previously, some large buy- and sell-side firms have begun the hard work of revamping infrastructures, workflows and budgets to facilitate the move to the shorter T+2 settlement cycle. Recently, we had the chance to speak to Ryan Burns, a senior vice president and co-manager of the Global Fund… Read More >>

SEC’s White: Don’t Wait for Us on T+2

The securities industry’s desire for regulatory certainty on shorter settlement cycles based on the trade date plus two business days (T+2) faces a bit of setback as SEC Chair Mary Jo White suggested the industry continue its work on achieving T+2 without waiting for the SEC to propose the necessary rules. The SEC strongly supports… Read More >>

Looking for a Few Silver Linings

For this week’s posting, I purposely tried to find news items that if not necessarily good news had some silver linings of hope and progress. I found three via my random, unscientific search. SEC Achieves Early $30 Million Settlement in Newswire Hacking Case The first piece I hit upon was the news from the SEC… Read More >>

‘I think there’s a big focus on back office now’

Andy Brown is the CEO and co-founder of Sand Hill East, a Basking Ridge, N.J.-based, soup-to-nuts incubator for financial technology startups of all kinds, including post-trade vendors such as Alpha Omega Financial Systems. The San Francisco-based startup is pushing for the post-trade use of the FIX protocol to eliminate manual Ops systems and to deliver… Read More >>

CFTC to Keep Using DTCC-SWIFT LEI Utility

Regulator CFTC has issued an order extending the designation of a utility operated by the DTCC and SWIFT as the provider of legal entity identifiers (LEIs) for the commission’s swap data recordkeeping and reporting rules, officials say. The DTCC-SWIFT utility — which had initially been referred to via the utility’s website and in educational and… Read More >>

T+2 Committee Wants ‘Clear Action’ via the SEC

The goal of shortening the U.S. settlement cycle to T+2 (trade day plus two days) by 2017 should be achievable, representatives of a securities industry T+2 initiative say. But regulators will have to step up to the plate and make the rules changes essential to getting the initiative off the ground. Specifically, that means SEC… Read More >>

Key Groups Push U.S. to Embrace T+2 by Q3 2017

Key industry organizations have issued an official timetable for a shorter, two-day process (T+2) for trade settlement in U.S. markets with the goal of implementation by the end of the third quarter of 2017. The suggested timeline via a whitepaper from the T+2 Industry Steering Committee (T+2 ISC) is intended to put the U.S. in sync with… Read More >>

Guidelines for T+2 Move in U.S. Due in June

The initial results of the industry-wide initiative for adoption of the T+2 (trade day plus two days) settlement cycle in the U.S. will be outlined in a white paper due out in early June rather than this month, confirms a DTCC official. Last fall, the DTCC and other industry groups unveiled the T+2 initiative for… Read More >>

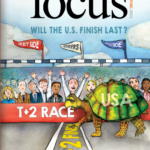

It’s Time for T+2 and FTF Focus Magazine

A very warm spring has come to the New York City area this week and coincidentally we are debuting a new online magazine from FTF News (a printed version is also available). To underscore our new commitment to magazine journalism, we have renamed the publication “FTF Focus,” and for this special edition, we took on… Read More >>

The FTF Focus T+2 Digital Magazine is Here!

Spring 2015 Spring brings hope that things will improve. With this in mind, FTF News has renamed its magazine to FTF Focus, and for this special edition, a single subject: the push to shorten settlement cycles. We cover the role of the post-trade services utility DTCC and how the European Union moved to T+2 last… Read More >>